There are four options available for individuals seeking to use retirement funds for their real estate investment.

- Regular Distribution

- Often subject to tax

- Subject to penalties if younger than 59 (and 6 months)

- Short Term Distribution

- Must be less than 60 days

- Can only be done once per year

- Must be less than 60 days

- Loan

- Only allowed with a 401k

- Out of the market and paying interest

- Self Directed IRA

- Can be risky (prohibited transactions)

- Can be subject to tax (UDFI or UBTI)

The self-directed IRA in particular can be polarizing as there are arguments for and against that option.

Reasons Against:

- You miss the tax advantages of rental real estate, i.e. the cash flow is positive, but it’s a loss for taxes.

- UDFI or UBTI, both of which can feel excessive.

- Prohibited transactions.

Reasons in Favor:

- Better return on investment than stocks or a REIT.

- More control over your investment.

How Does A Self Directed IRA Work?

First, make a trustee to trustee transfer from the current trustee to a Self Directed IRA trustee. Some will give you a check while others will form an LLC with the IRA as an owner. Open up a bank account and they will transfer funds to that account. Then, you can buy real estate and make all the management decisions.

How is it taxed?Investment income in the IRA is tax free (ROTH) or deferred (traditional IRA) with the exception of UDFI or UBTI.

What are prohibited transactions? Prohibited transactions are and financial exchanges between a plan, a “party in interest” (PII) or a fiduciary. This includes:

- The sale, exchange, or leasing of any property between the plan and a PII.

- The lending of money between the plan and a PII.

- The furnishing of goods, services, or facilities between the plan and a PII.

- Transfer to, or use by, or for the benefit of, a PII, of any assets of the plan.

- Acquisition on the plan’s behalf of any employer security or remployer real estate property.

What happens if you make a prohibited transaction? If you make a prohibited transaction, regardless of your intent, then it will be treated as though all assets of the IRA were distributed to the beneficiary.

Unrelated Debt-Financed Income Tax (UDFI)

When an IRA receives income from property that has been financed, a tax is applied on the resulting UDFI (or Unrelated Debt-Financed Income).

UDFI does not apply once the debt has been paid off for a total of 12 months. To calculate UDFI, apply the average acquisition indebtedness and divide by the average adjusted basis to the income produced. Then, report on 990-T.

UDFI Example 1:

The first year adjusted basis for a property would include the purchase price, closing costs, and any repairs or improvements. The total cost (in this instance) is $100,000.

The property was financed with a loan of $40,000. The debt-financed ratio is therefore 40%.

The property produced $12,000 in gross rents. 40% of this amount ($4,800) is considered to be derived from the debt financing and is therefore subject to tax.

Assuming depreciation and other deductions (such as real estate taxes and repairs) add up to $6,500, then 40% of this amount (or $2,600) is applied to reduce the income subject to tax, i.e. the $4,800.

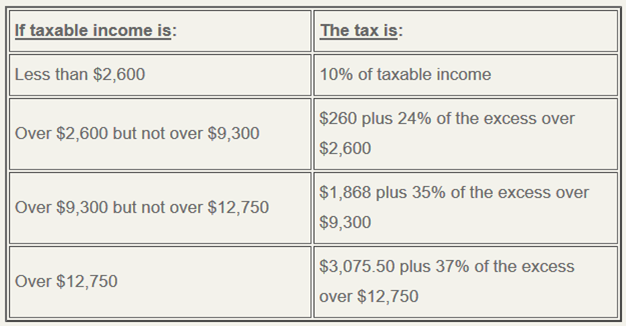

The resulting taxable amount would be $2,200 due to $4,800 in income minus $2,600 in deductions. This makes the trust tax rate 10%, or $2,200.

UDFI Example 2:

Say you were to sell that same home (from example 1) 5 years later. Given moderate appreciation, make the selling price $115,000.

On a 15 year mortgage at 7%, which is typical of non-recourse loans, the average indebtedness for the 5th year would be about $30,000. The adjusted basis of the property would be reduced by prior year’s depreciation to approximately $87,275. With these new values for average indebtedness and adjusted basis, the ratio of debt financing is now 34%.

After sales costs and paying off the balance of the mortgage, you would have gross proceeds of $75,000, 34% of which is subject to UDFI taxation. The taxable amount is therefore $35,500 (excluding for purposes of simplicity any allowable deduction you may have for the portion of the current year prior to the sale).

The net UDFI tax on this amount would be $11,493.

Unrelated Business Taxable Income (UBTI)

Exception to tax free status applies to the extent an exempt entity engages in a trade or business.

Passive investments not subject to UBTI:

- Dividends

- Interest

- Royalties

- Rents from real property

- Gains on the sale of property, so long as the property is not held primarily for sale to customers in the ordinary course of a business (i.e. flipping or new home construction)

Things to consider:

- Is the income generated from a trade or business activity?

- Is the activity engaged upon on a regular or repeated basis?

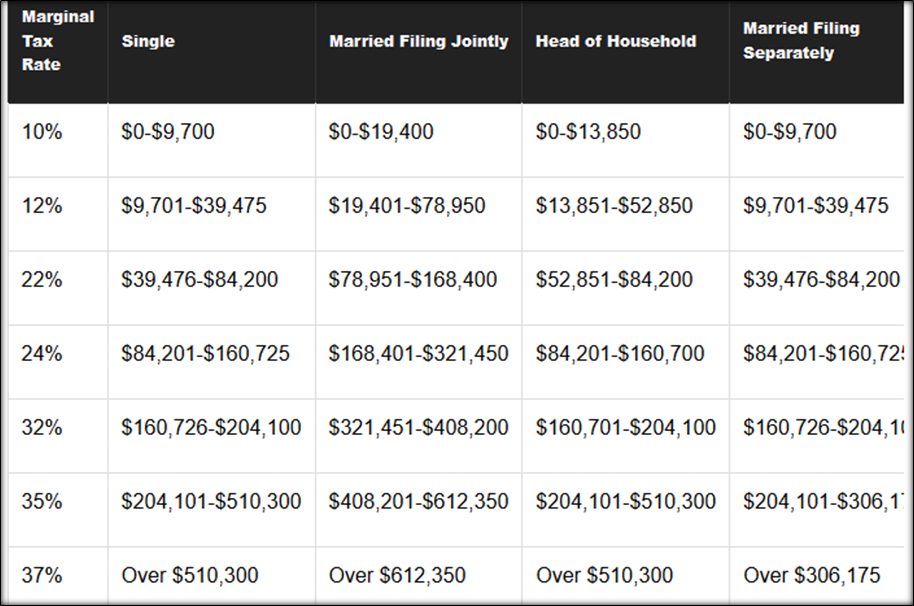

The tax rate schedule for trust in 2019