If you’ve ever worried that earning “too much” could bump you into a higher tax bracket and cause you to lose money, you’re not alone. A surprising number of people misunderstand how tax brackets actually work. The good news? It’s not nearly as punishing as it sounds.

Let’s clear things up and then talk about what small business owners can do to maximize their tax savings.

Tax Brackets Are Marginal, Not Flat

Here’s the key insight:

When you move into a higher bracket, only the income above the threshold gets taxed at that higher rate–which is an important distinction, it’s not all of your income.

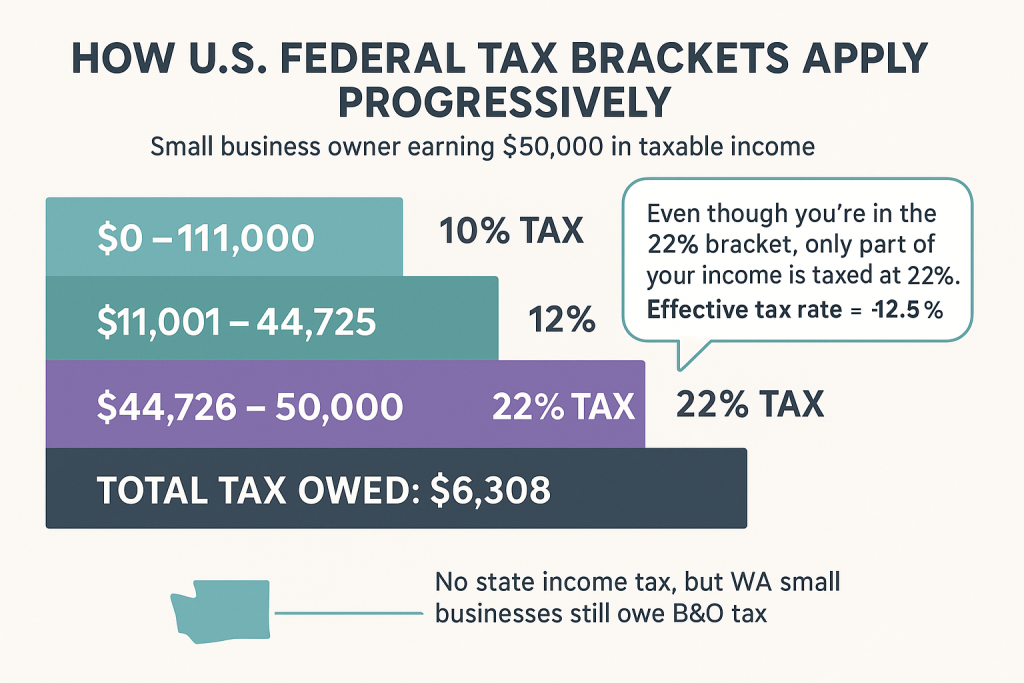

For example, let’s say your taxable income is $50,000. Here’s how it breaks down under a simplified bracket system:

- The first $11,000 is taxed at 10%, which comes to $1,100.

- The next $33,725 (income from $11,001 to $44,725) is taxed at 12%, which equals $4,047.

- The remaining $5,275 (income from $44,726 to $50,000) is taxed at 22%, which adds up to $1,161.

When you add it all together, your total tax bill is $6,308.

Even though your income puts you into the 22% bracket, only a portion of your income is taxed at 22%. Your effective tax rate is closer to 12.6%.

Even though this taxpayer falls into the 12% bracket, their effective tax rate is closer to 11%, because the lower income portion is still taxed at the lower 10% rate.

This is why earning more money is always better; you never lose money by crossing into a new bracket.

Why This Matters for Small Business Owners

As a business owner, understanding marginal tax brackets can help you make smarter decisions. Here’s how:

1. Income Timing

If you expect a higher tax year ahead, you may want to accelerate expenses into the current year or defer income until the next year. This can help keep more income in lower brackets.

2. Deduction Stacking

Some deductions (like Section 179 or bonus depreciation for equipment purchases) can dramatically reduce your taxable income, possibly keeping you in a lower bracket. Strategic planning matters here.

3. Retirement Contributions

Contributing to retirement accounts like a SEP IRA, Solo 401k, or SIMPLE IRA can reduce taxable income today–potentially keeping you in a lower bracket while building long-term wealth.

4. Health Savings Accounts (HSAs)

If you qualify, HSA contributions lower taxable income and avoid FICA taxes if run through payroll. Again, these savings may keep more of your income taxed at lower rates.

5. Entity Structure Planning

Sometimes, the way your business is structured (LLC, S Corp, partnership) can influence how much of your income is subject to self-employment tax and how it flows through to your personal return. Done right, this can minimize bracket creep.

The Big Picture

Tax brackets aren’t a punishment. They’re a graduated system, designed so you only pay higher rates on the portion of income above each threshold.

For small business owners, this means you can:

- Confidently grow revenue without fear of “losing money to taxes.”

- Use deductions, retirement accounts, and income planning to manage which brackets you land in.

- Focus on net profitability rather than obsessing over the bracket label.

If you’ve just had the “aha!” moment that tax brackets don’t work the way you thought, you’re already ahead of many business owners. The next step is putting that knowledge into practice with proactive planning.