Form 1120-S is an income tax return for S corporations. S corporations are corporations that have elected to pass their income, losses, deductions, and credits through to their shareholders for federal tax purposes. This means that the shareholders of an S corporation report their share of the corporation’s income and losses on their personal tax returns, and are assessed tax at their individual income tax rates.

In addition to Form 1120-S, S corporations may also need to file other forms, such as Form 2553, Election by a Small Business Corporation, and Schedule K-1, Shareholder’s Share of Income, Deductions, Credits, etc.

To start, let’s review how to fill out form 1120-S.

Form 1120-S Instructions

1. Gather your information

Before you start filling out the form, gather the following information about your business so you’re good to go. This includes:

- The business’s name

- The business’s taxpayer identification number (TIN)

- The business’s address

- The business’s fiscal year

- The business’s income and expenses

- The names and addresses of your shareholders

2. Download the form

You can download Form 1120-S from the IRS website.

3. Start filling out the form

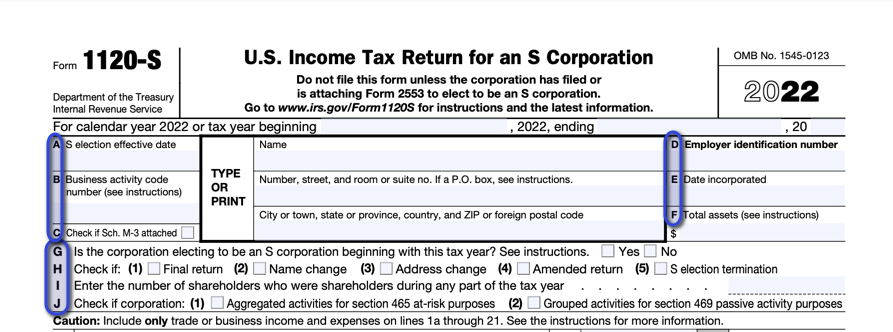

The first few pages of the form are mostly identification information. Be sure to fill out these pages carefully, as they will be used to identify your business and its shareholders.

- Lines A-J: These lines identify the corporation and its shareholders. The information on these lines can be found in the corporation’s articles of incorporation, bylaws, and shareholder records.

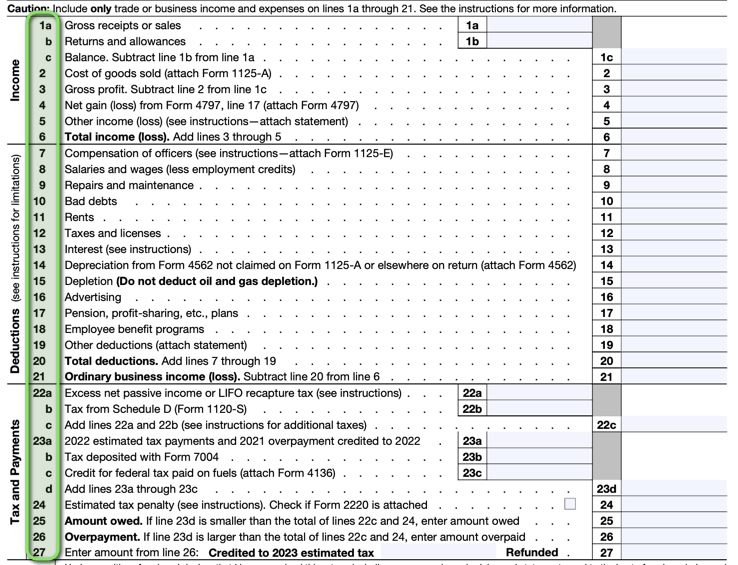

On the next few pages, you’ll need to report your business’s income and expenses. This information will be used to calculate your taxable income.

- Lines 1-27: These lines report the corporation’s income and expenses. The information on these lines can be found in the corporation’s financial records.

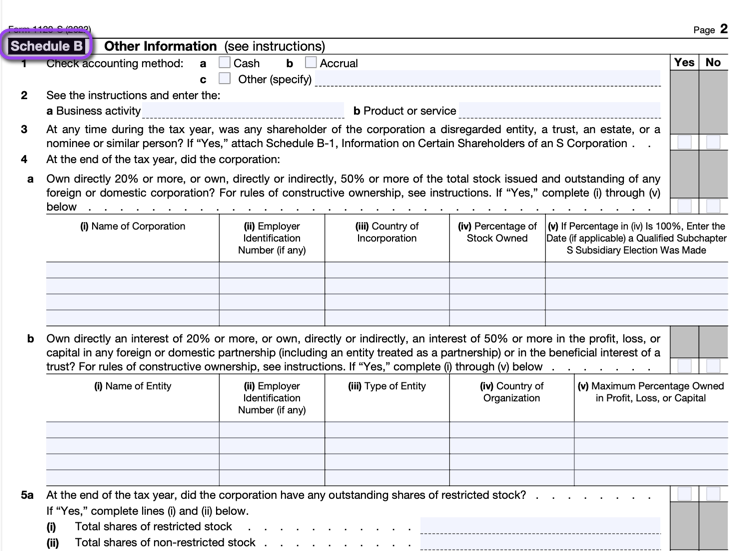

4. Filling out Schedule B

- Schedule B: This schedule reports the corporation’s distributions to shareholders. The information on this schedule can be found in the corporation’s minutes or other records of shareholder distributions.

- Lines 1-11b: These lines report the corporation’s accumulated earnings and profits (AE&P). AE&P is the amount of income that the corporation has earned but has not yet distributed to shareholders.

- Schedule B continues on page 3 with lines 12-15 for reporting the corporation’s distributions to shareholders.

5. Complete Schedule K-1.

Schedule K-1 is a form that lists each shareholder’s share of the business’s income, deductions, credits, and other items. You’ll need to complete a separate Schedule K-1 for each shareholder.

Note: If you’re the only shareholder, you don’t need to file a separate Schedule K-1. Schedule K-1 is a form that lists each shareholder’s share of the business’s income, deductions, credits, and other items. Since you’re the only shareholder, there’s no one else to share the information with.

However, even if you’re the only shareholder, you still need to file Form 1120-S. This form reports the corporation’s income and expenses, and it’s necessary for the IRS to track the corporation’s tax liability.

Here are the steps on how to file Form 1120-S if you’re the only shareholder:

- Download Form 1120-S from the IRS website.

- Fill out the form, including all of the required information.

- File the form electronically or by mail.

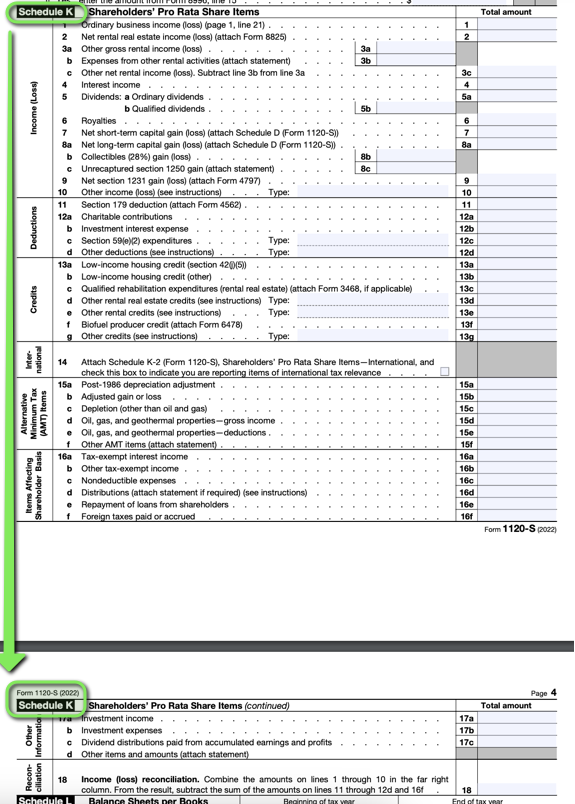

- Schedule K: This schedule reports the corporation’s income, deductions, credits, and other items that are passed through to shareholders. The information on this schedule can be found in the corporation’s financial records.

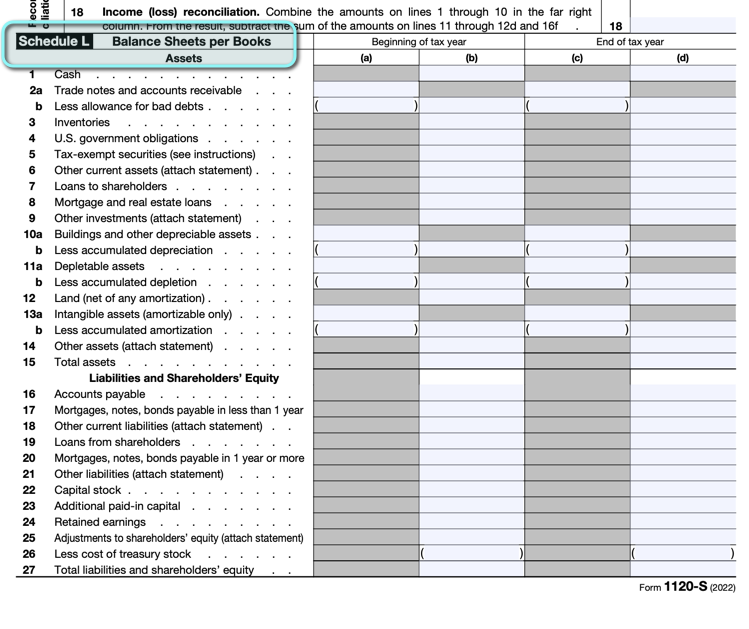

6. Filling out Schedule L

- Schedule L: This schedule reports the corporation’s assets, liabilities, and equity. The information on this schedule can be found in the corporation’s financial records.

- Lines 1-17: These lines report the corporation’s shareholders’ equity.

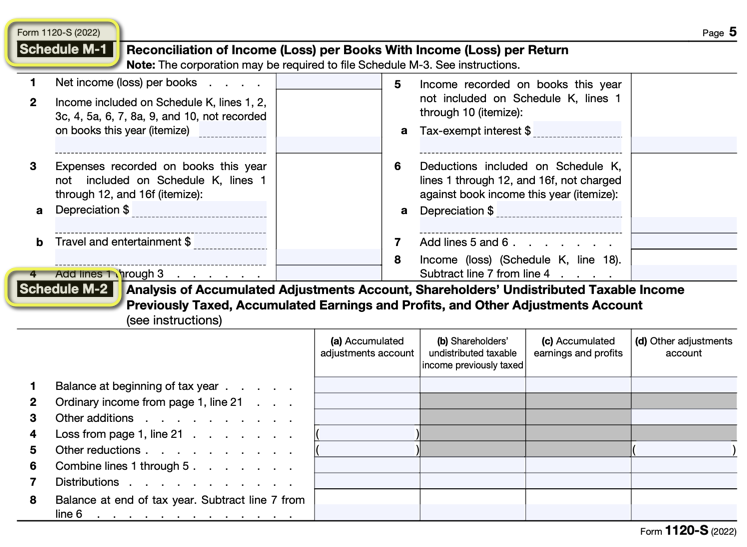

7. Filling out Schedule M-1 & Schedule M-2

- Schedule M-1: This schedule reconciles the corporation’s book income to its taxable income.

7. Filing the Form

Once you’ve completed the form, you can file it electronically or by mail. If you’re filing electronically, you can do so through the IRS’s e-file system. If you’re filing by mail, you can send the form to the IRS address that’s listed on the form.

Here are some additional tips for filing Form 1120-S:

- Make sure you have all of the necessary information before you start filling out the form.

- Be sure to fill out the form carefully and completely.

- If you have any questions, consult with a tax professional.

Common pitfalls and mistakes

Here are some of the most common pitfalls that people make when filling out Form 1120-S:

- Not providing all of the required information. The instructions for Form 1120-S are specific to the information required. Make sure that you provide all of the required information, or your return may be rejected.

- Making mistakes in the calculations. The calculations on Form 1120-S can be complex. Make sure that you carefully follow the instructions and double-check your calculations before you file your return.

- Not filing Schedule K-1. Schedule K-1 is a form that lists each shareholder’s share of the business’s income, deductions, credits, and other items. You must file a separate Schedule K-1 for each shareholder — unless you are the only shareholder, in which case form 1120-S Schedule K is enough.