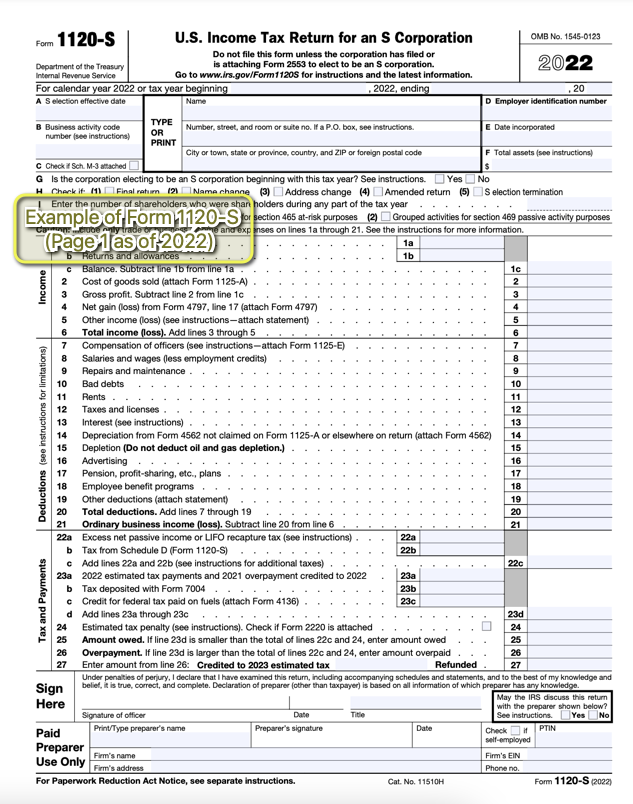

Form 1120-S is an income tax return for S corporations. S corporations are corporations that have elected to pass their income, losses, deductions, and credits through to their shareholders for federal tax purposes. This means that the shareholders of an S corporation report their share of the

When Can You Expect Your Tax Refund?

A good number of people are eligible to receive a tax refund from the IRS. Yet, as a result of the COVID-19 pandemic, taxpayers have experienced delays in getting their tax refund. Due to backlogs of 2020/2021 tax refunds processing, the IRS will delay the processing of 2022 refunds. The pandemic

Tips To Finding A Good Tax Adviser

No matter what your tax situation, tax season can be a huge headache. The more complex your financial situation is, the more difficult filing your taxes can be. This can be doubly true if you’re a business owner; trying to handle all of the credits, deductions, and various incomes for a

How to Determine Which Filing Status is More Beneficial

Unfortunately, most people cannot choose their tax status when it comes to filing taxes. Your status is determined by your current set of life circumstances and your income. If you are unmarried without children, you must file as single. If you are a single parent, you can claim yourself as head of

You Missed the Tax Deadline?Now What?

Deadlines and dates get away from people all the time. In our fast-paced, hectic society, missing a deadline on occasion is practically inevitable. The good news is that if you have missed your tax deadline, there are remedies available which are not detrimental to your financial stability. The few

4 Ways to Start Planning for the Next Tax Season Now

Planning ahead for the next tax season should begin with the new tax year on January 1st. It is best to determine how much tax you will be expected to pay and where you can make cuts to make those savings. When you are able to plan ahead, not only does it cut down the time in your preparations, the

How Wealthy People Avoid Paying Taxes

The wealthy seem to have all kinds of tricks up their sleeves to avoid paying taxes. While some simply do not file, others have learned where the loopholes are. It may be a good idea to put some of these tricks to use to help reduce your individual tax liability. Overseas Accounts If you own a

How to Estimate Your Tax Refund

It is possible to estimate your tax refund or the amount that you might owe before getting your tax documents from employers. Doing so helps you budget for expected payments or make plans for your refund. There are a few options to help you compute your estimate accurately. Online Tax Estimating