Taxation, the practice of levying charges on individuals or businesses to generate revenue for government services, has been a fundamental aspect of human civilization for millennia. Its origins can be traced back to ancient societies, where tribute was paid to rulers and gods. Early Forms of

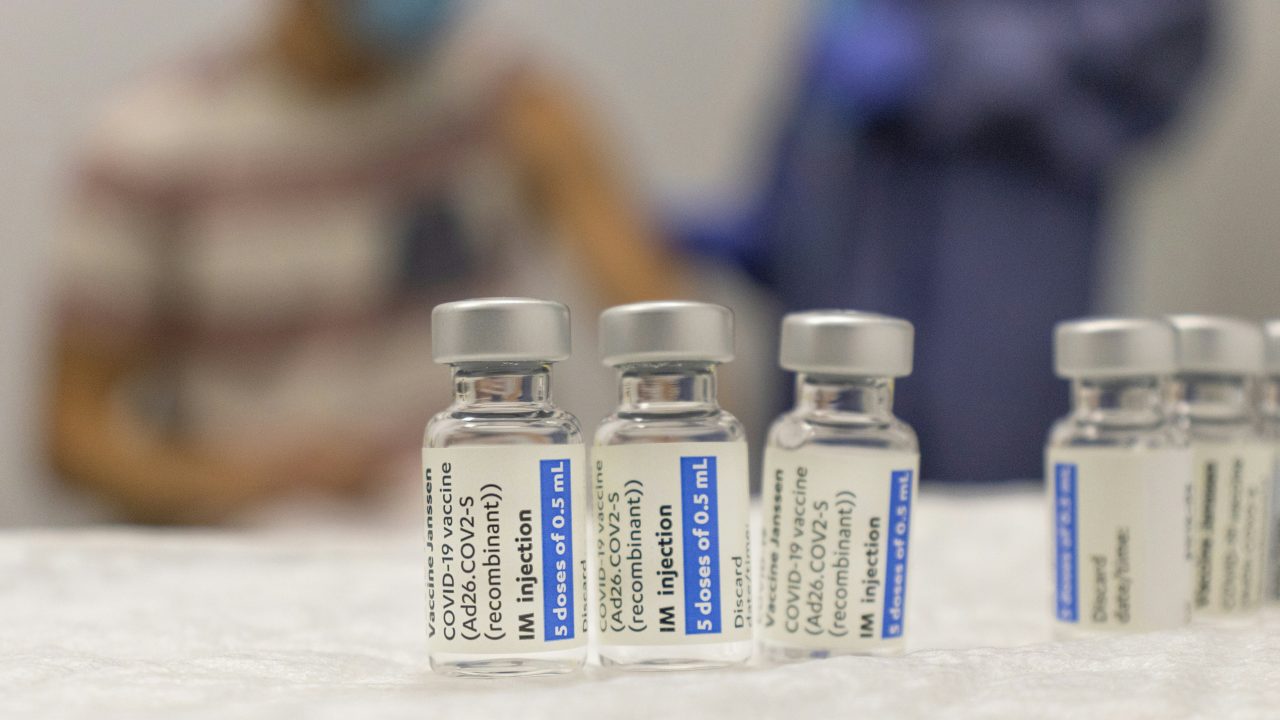

Comparing Revenue Management Models in Healthcare

In the dynamic landscape of healthcare, revenue management plays a crucial role in ensuring the financial sustainability of providers. A well-crafted revenue model can significantly impact a healthcare organization's profitability and ability to deliver high-quality care. This blog post will explore

Medicare and Medicaid: Balancing Books for Medical Practices

As a medical practice owner, you're often juggling a multitude of responsibilities. Patient care, operational efficiency, to speak nothing of the growing the practice itself. Every decision counts, and of course, one of the biggest ones you can make is whether or not to accept Medicare and

Filing Taxes for Your Private Practice

Filing taxes as a private practice owner can be complex, especially with the unique financial aspects of running a healthcare business. Understanding the key tax considerations and following best practices can help you ensure accuracy and minimize your tax liability. Understanding Your Tax

Top 7 Things Senior Living Owners Need to Know About Taxes

Understanding the tax implications of owning and operating a senior living facility can significantly impact your bottom line. Here are 15 essential tips to help you navigate the complex world of healthcare accounting: 1. Depreciation and Amortization Depreciation is a tax deduction that

The Tax Contributions of Undocumented Immigrants: A Complex Issue

The debate surrounding undocumented immigrants and their tax contributions is a multifaceted one, often clouded by misconceptions and political rhetoric. Understanding the complexities of this issue requires a careful examination of the various ways in which undocumented individuals interact with

Payroll Tax Withholding Simplified

Payroll tax withholding can be a daunting task for small business owners. But understanding the basics is essential for staying compliant with tax laws and avoiding penalties. Let's break down this complex topic into simple terms. What is Payroll Tax Withholding? Payroll tax withholding is the

STTR: A Catalyst for Innovation

The Small Business Technology Transfer (STTR) program is a government initiative designed to foster innovation by funding research partnerships between small businesses and non-profit research institutions. This unique collaboration model has been instrumental in driving technological advancements