If you own a business, hiring a bookkeeper is going to make your life a lot easier. Your bookkeeper does more than keep track of your business' financials, they also weigh your successes and failures, and help you reach your goals by determining time vs effort and cost. Your bookkeeper creates a

Should You Hire an Accountant or Use TurboTax?

Between January and April every year, many Americans suffer the same dilemma that seems to never be solved; should you be doing your taxes with an accountant or with Turbotax?. This inner conflict is not a new one, and doesn’t have any one definable yes or no answer. The truth, ultimately, depends

Balancing the Budget

Are you a small business owner wanting to make the wisest financial decisions possible? Have you discovered that your freelance business’s earnings are dwindling away, but you have no idea why? Do you find yourself putting in more work and time, but you can’t see a return for the investment? If so,

Your Business’ Bookkeeper

Bookkeeping for startups is essential since it shows accurate information regarding the business. It involves recording financial data that includes sales, receivables, receipts, purchases, payables, and payments as well. On that account, you can store documents and retrieve them when you require

Small Business Accounting: Tracking Expenses and Time

In my experience, there are two kinds of entrepreneurs. Those who worked for other companies, saw the pain points and the selling points, recognized the workflow, value proposition, and decided to take a chance on their own. The other entrepreneur is the one who starts as a hobbyist, one who does

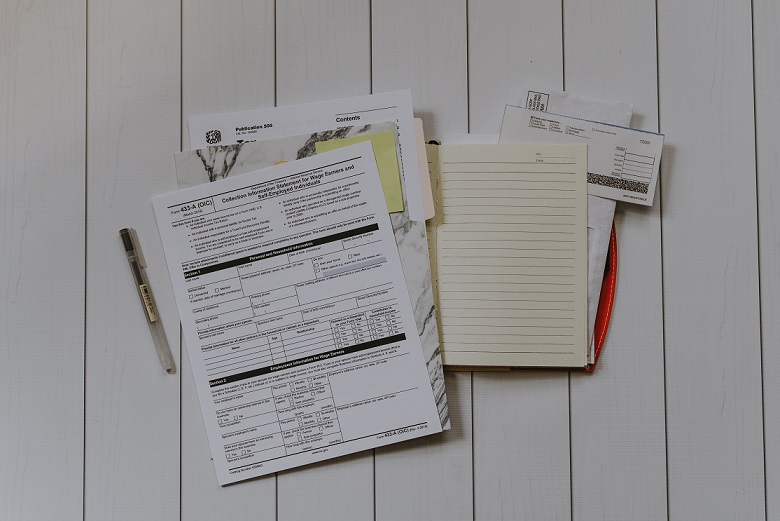

Ready for Tax Day 2020?

UPDATE: 6/15/2020 - The tax deadline has been postponed to July 15, 2020 due to the coronavirus pandemic. As 2019 draws to a close, many are preparing (read: dreading) to file their taxes come April 2020. Taxes are due April 15, 2020. Missing the deadline can open the door to unwanted

Accounting for Startups

Accounting for startups entails keeping strict (and accurate) financial records and detailed accounts to project the organization's growth. As a business owner, accounting is absolutely vital to discern what trajectory your business is on, so you know what you can afford. If you're trying to do

What Type of Business Should Operate as a Sole Proprietorship?

A sole proprietorship is undeniably the easiest, lowest-costing entity to form and manage. That said it's not the best option for all businesses, in some cases an S Corp or LLC might make more sense. Here are some of the advantages of a sole proprietorship: Simplicity - This is by far the least