Washington State has enacted significant tax reforms under Governor Bob Ferguson's administration, introducing approximately $9 billion in new taxes over the next four years. These changes, aimed at addressing a substantial budget shortfall, have profound implications for small business owners in

Lessons from Dickinson v Dodds

In the fast-paced world of business, timing can make or break your success. Whether you’re launching a new product, pitching a deal, or selling your company, being too early or too late can cost you more than just opportunities—it can cost you real dollars. In today’s landscape, where competition is

The Tea Act of 1773: a Tax that Shaped History

When most of us think of taxes, we picture paperwork, spreadsheets, and a mountain of forms to file by April 15th. Taxes can feel like the ultimate bureaucratic headache—mundane, necessary, but hardly revolutionary. Yet, history shows us that taxes have often been at the heart of dramatic change,

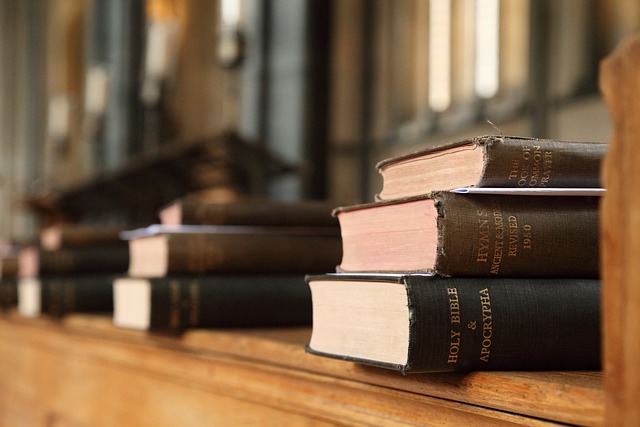

Accounting for Churches and Nonprofits

Accounting for churches and nonprofits isn’t just a variation of business accounting—it’s a fundamentally different world. Unlike for-profit businesses that focus on generating revenue and maximizing profit, nonprofits and churches exist to serve a mission, not a bottom line. This means their

New Business Applications Slow in Seattle

Seattle, once a thriving hub for entrepreneurial ventures, has seen a marked decline in new business applications in recent years. In 2022, there were just 7,710 new business applications, a sharp 42% drop from the pre-pandemic annual average of 13,305. This slowdown reflects broader challenges in

Financial Tips for Realtors: the Highs & Lows

Being a realtor demands resilience and sharp financial management. The ever-changing housing market can lead to significant income fluctuations, making it essential to plan wisely for both boom years and lean times. Here are some strategies to help you thrive through the real estate

Reasons To File Your Taxes Early

Many taxpayers delay filing until the April 15th deadline, assuming there’s no harm in waiting. However, filing your taxes early offers several advantages, from faster refunds to better financial planning. Here are the top reasons why you should consider filing your taxes as soon as possible this

Seattle’s Financial District: Challenges and Opportunities for SMBs

Seattle’s financial district continues to face significant challenges, as high office vacancy rates and rising commercial real estate loan defaults create uncertainty for the city’s downtown core. According to recent data, Seattle ranks among the most vulnerable financial districts in the US,