In the world of investing, there’s a famous piece of wisdom often attributed to the late Charlie Munger: "The first $100,000 is a *****, but you gotta do it." For many Seattle business owners, the climb to that first $100,000 in personal investments can feel like a relentless uphill battle. But is

What to Do if Your Tax Refund Is Too Large

I know, good problems to have, right? Receiving a larger-than-expected tax refund might feel like a stroke of luck, but for a business owner in Seattle, it can often be a sign of a looming audit or a clerical error that needs immediate attention. Whether it's a simple math error on your 1040 or a

Is That Startup Note a Strategy or a Sham?

In the competitive business landscape, business owners are constantly looking for an edge. Whether you are scaling a SaaS startup in South Lake Union or managing a growing medical practice in Kirkland, the goal is always the same: keep more of what you earn. However, there is a fine line between

The MBA Reimbursement Dilemma: Is Your Startup’s Education Assistance Plan Audit-Proof?

For many Seattle tech founders, the line between "building a business" and "getting an education" often blurs. We frequently see SaaS founders in the South Lake Union or Bellevue ecosystems who transition directly from an MBA program into a high-growth C-Corp. The question is: Can your startup

Is the ROBS Strategy Too Good to Be True?

TL;DR: ROBS is a high-risk, high-maintenance strategy. It is great for entrepreneurs who have $500k in a 401(k) but $0 in the bank and need to buy a franchise. For a profitable business like yours, an S-Corp usually offers the best balance of tax savings and "sleep-at-night" security. High-Stakes

How to Manage Estimated Taxes with Multiple Income Streams

Moving from a straightforward W-2 salary to a "portfolio" of income streams -- interest, dividends, and capital gains -- is a sign of financial growth, but it’s also the moment many Seattle professionals realize the IRS has a "pay-as-you-go" philosophy. If you're used to an employer handling your

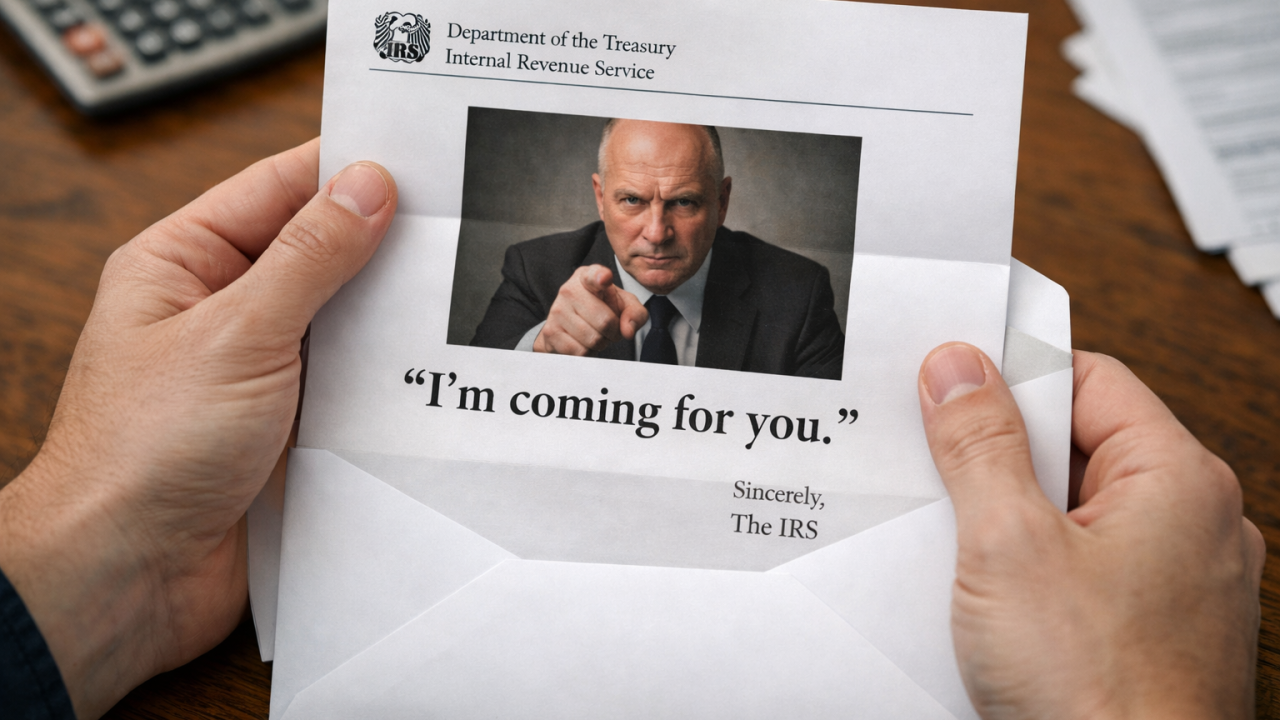

IRS Letters, Liens, and Levies: What’s Actually Happening (and What to Do Next)

If you’ve received multiple letters from the IRS and they’re throwing around words like lien and levy, you’re not wrong to feel anxious. Those terms sound extreme, and most IRS notices are not written for regular people. Let’s break this down in simple terms so you can understand where you

Should You Prepay Property Taxes to Get an Itemized Deduction?

Every year around tax time, homeowners ask the same question: Should I prepay my property taxes to get a bigger deduction? The short answer is: sometimes it helps, often it doesn’t, and in many cases the benefit is smaller than people expect. Let’s walk through when prepaying property taxes